Understanding the “Khela” of Risk Transfer and Monopoly Creation

A Critical Examination of Equity, Risk Allocation, and Cost Inflation under HAM-Type Models

Abstract

Public–Private Partnerships (PPPs) and Hybrid Annuity Models (HAM) were designed to mobilise private-sector efficiency while protecting public interest through balanced risk sharing. However, evidence from multiple emerging-market infrastructure programmes suggests that certain PPP/HAM structures may unintentionally enable the transfer of public capital into privately controlled assets with limited private risk exposure. This article examines a representative financing structure in which project costs are inflated, government equity substitutes for promoter capital, and bank lending—ultimately backed by public deposits and implicit sovereign support—absorbs most downside risk. The analysis highlights structural moral hazard, weak incentive alignment, and long-term fiscal and market implications, including the conditions under which such contracts can facilitate durable monopoly power.

1. Introduction

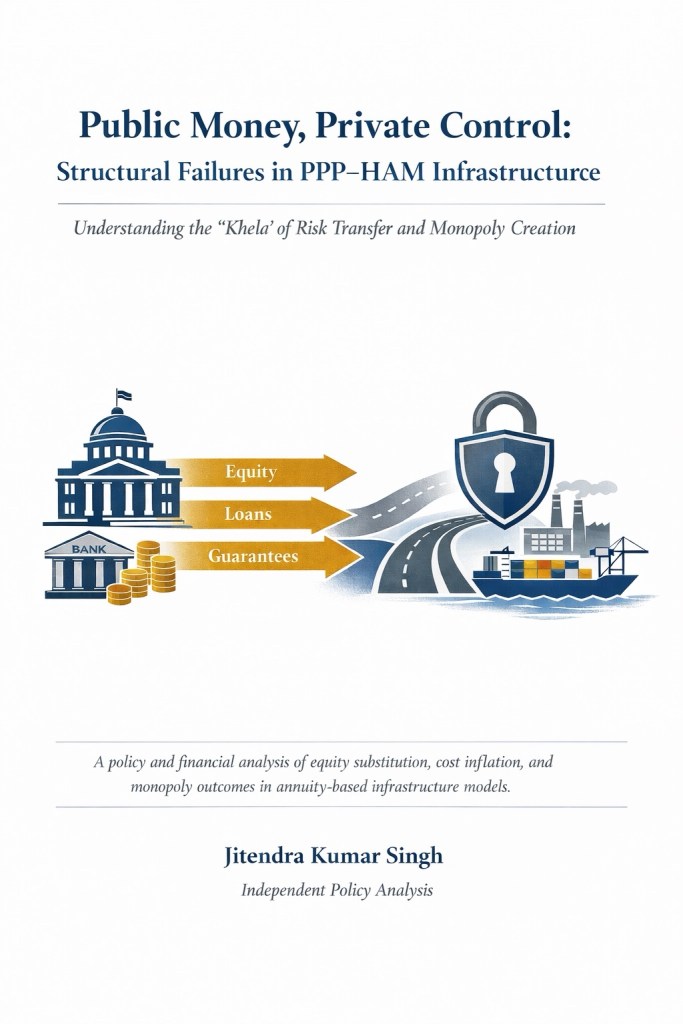

PPPs are widely promoted by multilateral institutions as mechanisms to close infrastructure gaps under fiscal constraints. By combining public support with private execution, PPPs seek to improve efficiency, accelerate delivery, and optimise lifecycle costs. Outcomes, however, depend critically on project structuring—particularly how capital, risk, and control are allocated.

Recent experience with annuity-based PPP variants, including HAM-type arrangements, raises concerns that some projects have shifted from risk-sharing partnerships toward publicly financed, privately controlled infrastructure concessions, with asymmetric risk transfer away from private sponsors.

2. A Representative Financing Structure

Consider the following stylised but plausible project structure:

Actual economic cost: ₹1

Reported project cost (DPR): ₹10

Financing mix

Government equity / grant: ₹4

Bank loan to concessionaire :₹4.2

Promoter equity: ₹1.8

Although contractual control rests with the private concessionaire, 100% of the financial input is public—directly through government equity/grants and indirectly through bank lending backed by deposits and implicit sovereign support.

3. Cost Inflation and Early Value Extraction

Inflated project costs create surplus financial headroom that can be captured during construction through mechanisms such as:

Related-party EPC contracting Management fees and overhead allocations Non-transparent procurement and change orders

This structure enables sponsors to extract economic value well before operations commence, often with limited dependence on long-term service performance. From a finance perspective, this represents front-loaded rent extraction, contradicting the lifecycle-efficiency rationale commonly used to justify PPP adoption.

4. Risk Allocation and Moral Hazard

The defining feature of the structure is the absence of promoter risk capital. When private sponsors have no equity at stake:

Downside risk is concentrated on government and banks Financial closure can dominate over project fundamentals Incentives for cost discipline and service quality weaken

If revenues underperform, typical contractual or administrative remedies include:

Extension of concession periods Annuity restructuring Debt rescheduling, refinancing, or haircuts

These interventions often protect the concessionaire while shifting losses to public balance sheets—an archetypal case of moral hazard.

5. Banking Sector Implications

Public-sector banks may treat such projects as low-risk due to:

Government equity participation Long-term annuity commitments Strategic and political prioritisation of infrastructure delivery

However, where cost inflation and weak operational cash flows emerge, banks face:

Stressed assets and rising NPAs Depressed risk-adjusted returns Capital erosion requiring recapitalisation—often funded by taxpayers

In effect, household savings can become indirectly exposed to infrastructure risks without commensurate public benefit or depositor upside.

6. Monopoly Formation and Market Distortion

Once operational, publicly financed assets are frequently granted:

Long exclusive concession periods (often 20–30 years) Guaranteed or quasi-guaranteed cash flows Limited competitive pressure after award

This can generate state-enabled monopoly or oligopoly outcomes, where dominance results not primarily from innovation or efficiency but from preferential access to public capital, contractual protections, and repeat-win capability. Over time, such concentration can crowd out smaller firms and weaken competitive infrastructure markets.

7. Reframing the Model: From PPP to Publicly Funded Private Control

When:

Government provides equity Banks provide debt Promoters provide control but not capital

the arrangement departs materially from a PPP in economic substance. Functionally, it resembles outsourced public infrastructure in which public financing underwrites private control over long-duration cash flows. This distinction matters for transparency, accountability, and fiscal sustainability—and for honest classification of the model in policy discourse.

8. Policy Safeguards and International Best Practices

International practice suggests multiple safeguards to restore incentive alignment:

Minimum promoter equity requirements (verifiable, “skin in the game”) Independent cost benchmarking using market comparables and reference class forecasting Clawback mechanisms for windfall margins linked to cost inflation or refinancing gains Strict limits and disclosures on related-party transactions Dynamic risk rebalancing clauses across construction and operations, including performance-linked payments

Absent these safeguards, PPP/HAM-type structures risk becoming channels for systematic public value leakage.

9. Reflection Summary

PPPs remain valuable instruments when designed with credible risk sharing and aligned incentives.

However, structures that eliminate private risk while preserving private control undermine the foundational logic of partnership. For infrastructure finance to be efficient and equitable, capital contribution, risk exposure, and reward must remain aligned.

When alignment fails, PPPs can shift from development tools to mechanisms of public capital extraction eroding trust in markets, institutions, and infrastructure policy itself.

Leave a comment